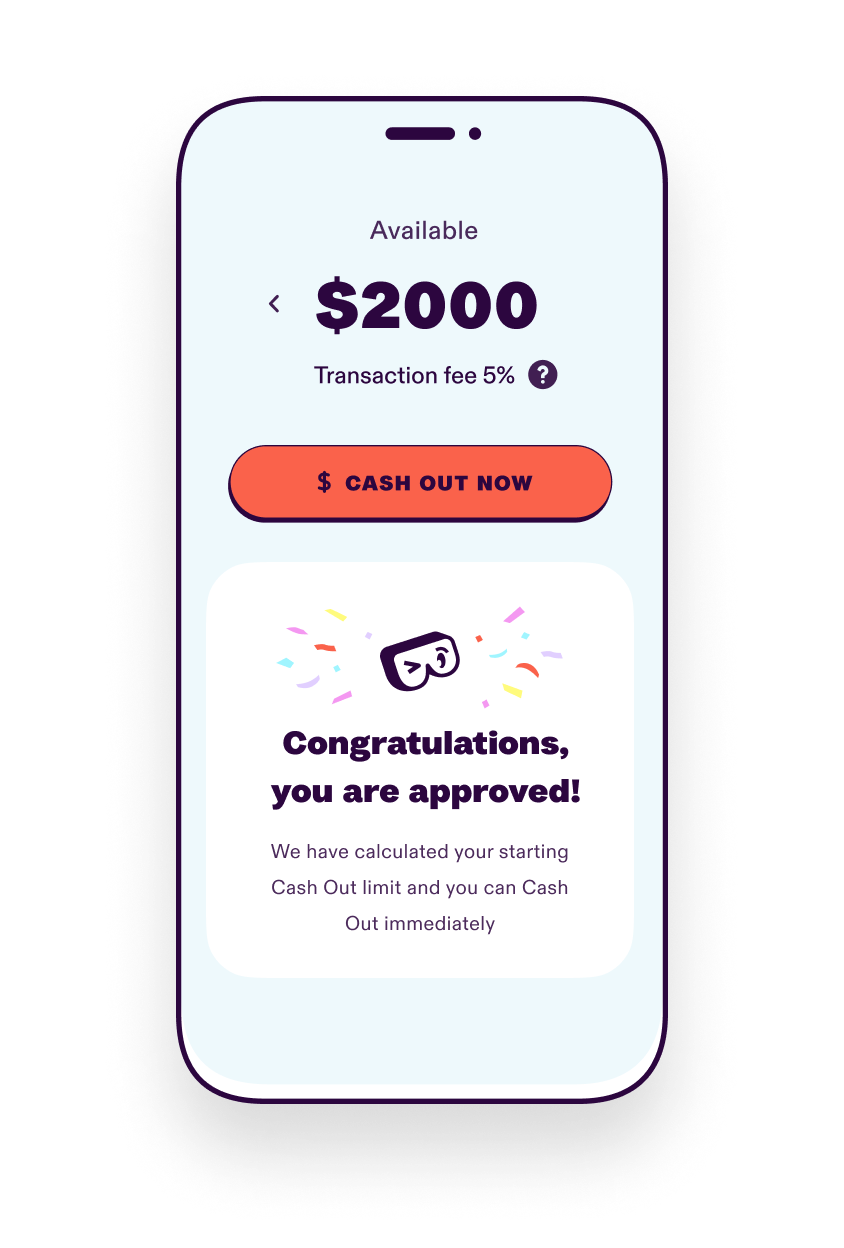

How do I access my pay early?

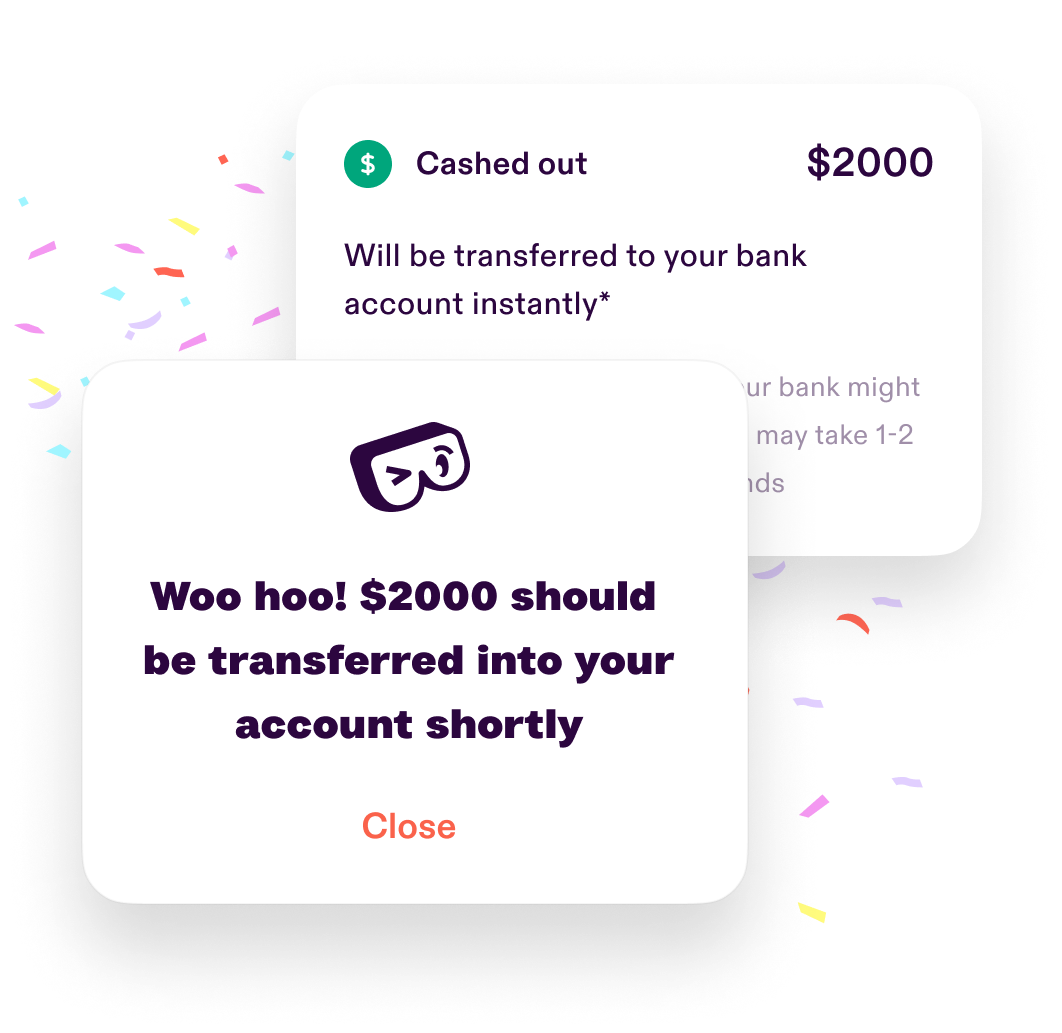

When life throws you a bit of a curveball and you need some extra cash between pays, Beforepay can help. Simply create an account, connect your bank, and verify your identity, and you'll be able to borrow up to $2000 (depending on eligibility).

See common use cases for Beforepay Pay Advance.

Can I get a loan with bad credit?

Yes you can! No matter your credit, you could still be eligible for a Pay Advance loan. We do our own checks of each borrower to ensure we are lending safely and affordably, but we don't check your credit history for Pay Advance. Even better, a Pay Advance won't affect your credit history.

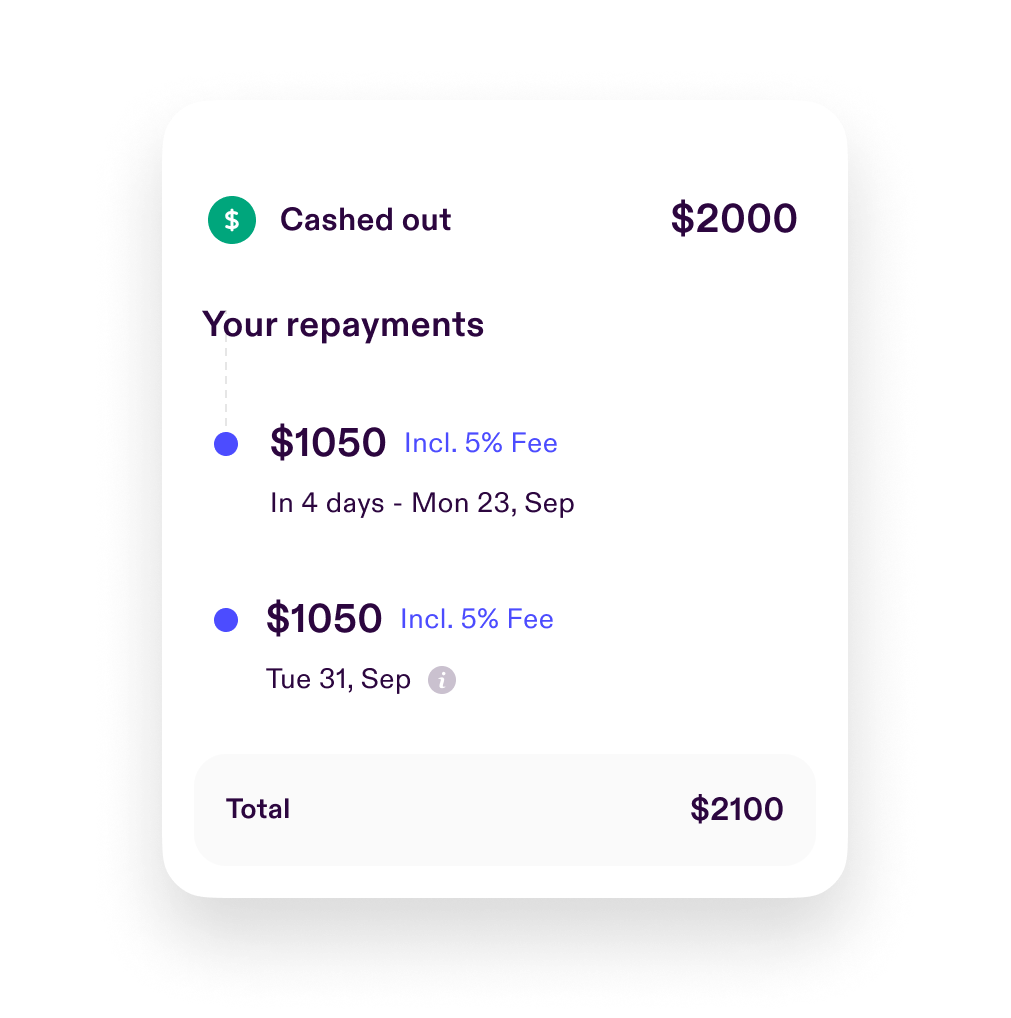

Know what you owe upfront

Our fees are simple and transparent. You'll have a clear view of what you owe once you cash out, so you won't be caught offguard about any fees and charges. We charge a fixed fee on each advance, that is 5% of what you borrow.

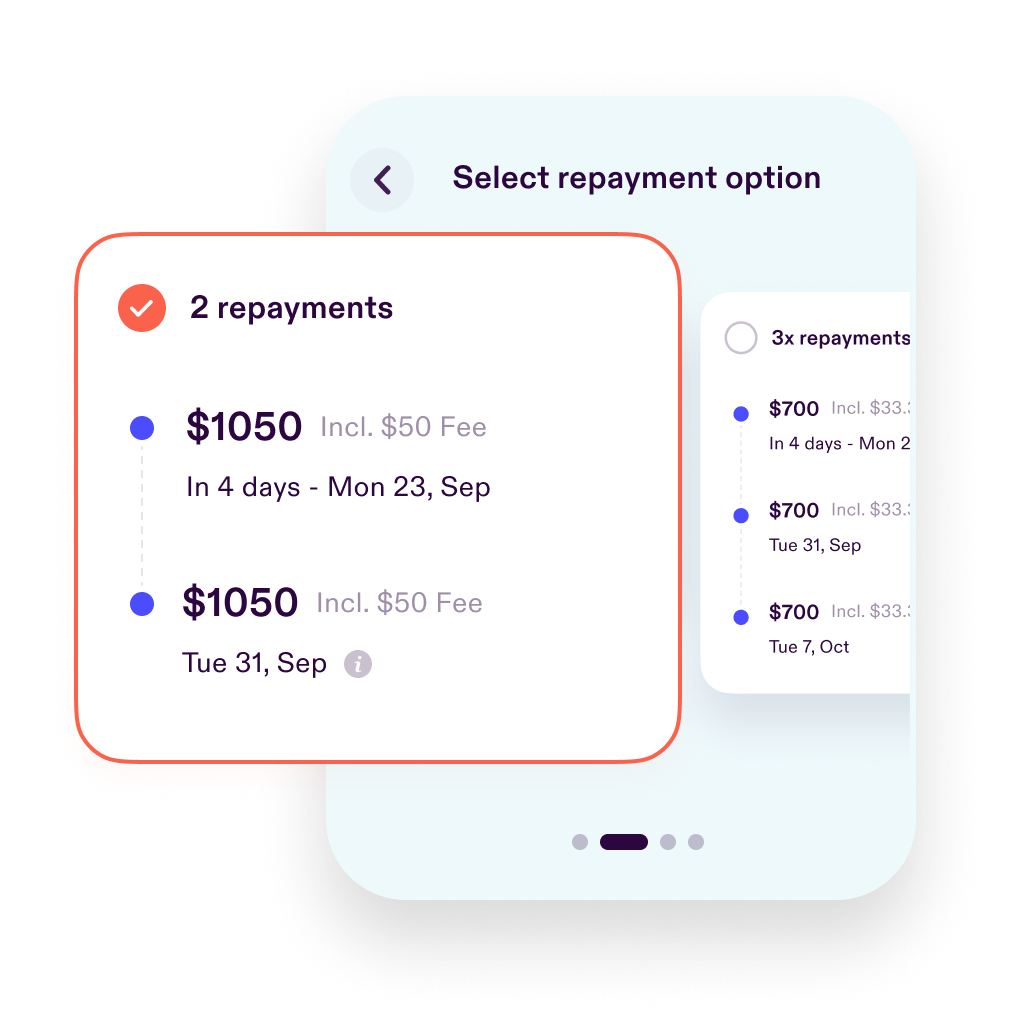

Repay your advance in up to 4 instalments

We’ve got the smarts to align repayments with your pay cycle so that you can repay your Pay Advance when you get paid—simple, and worry-free. You can spread out your repayment across up to 4 instalments, as long as the full repayment is made within 62 days from your cash out date.

Am I eligible for a Pay Advance with Beforepay?

To cash out a Pay Advance with Beforepay you’ll need to meet the below eligibility requirements. You will also need to successfully verify your ID and meet the requirements of our credit risk assessment. Learn more here.

-

Be 18 years or older and an Australian resident.

-

Have a current driver's licence (Australian only), passport or Medicare card (or otherwise pass the identification criteria set out by Beforepay).

-

Be employed and earn a wage. Employment may include self-employment, provided that you are an individual and all other eligibility criteria is met.

-

Not earn more than 51% of your total income from Centrelink.